Manufacturing Sentiments Remain Positive in First Quarter: FICCI Survey

Jul 17, 2023

Domestic Demand Outlook Remains Optimistic

Future Investment Outlook Improves

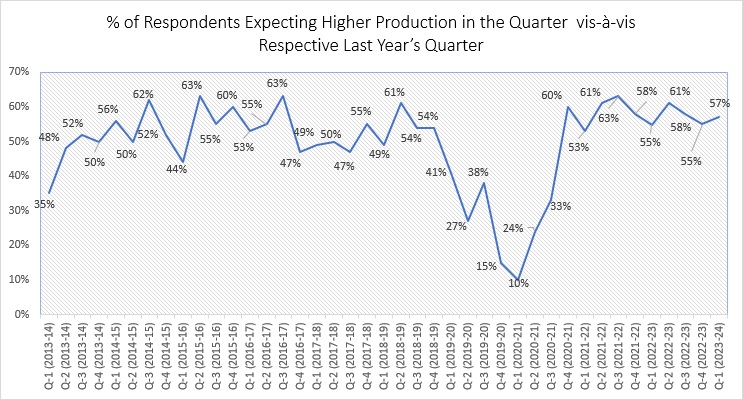

NEW DELHI, 17 July 2023: Global headwinds notwithstanding, FICCI’s latest quarterly survey on Manufacturing reveals that sentiments remain positive for Indian manufacturing during first quarter of 2023-24. The survey observed that after experiencing revival of Indian economy in the FY 2021-22, momentum of growth has continued for the subsequent quarters as well. In the Q4 Jan-March FY 2022-23, 55% of the respondents reported higher production levels. Further, over 57% of the respondents expect a higher level of production in Q1 Apr-Jun 2023-24 with an average increase in production in single digits. This assessment is also reflective in order books as 58% of the respondents in Q-1 Apr-Jun 2023-24 have had higher number of orders and demand conditions especially domestic, continue to be optimistic in Q-2 Jul-Sept 2023-24 as well, noted FICCI survey.

FICCI’s latest quarterly survey assessed the sentiments of manufacturers for Q-1 April-June (2023-24) for nine major sectors namely Automotive & Auto Components, Capital Goods & Construction Equipment, Cement, Chemicals Fertilizers and Pharmaceuticals, Electronics & White Goods, Machine Tools, Metal & Metal Products, Textiles, Apparels & Technical Textiles, Toys & Handicrafts and Miscellaneous. Responses have been drawn from over 400 manufacturing units from both large and SME segments with a combined annual turnover of over Rs. 7.70 lakh crores.

Figure: % of Respondents Expecting Higher Production in the Quarter

vis-à-vis Respective Last Year’s Quarter

Source FICCI Survey

Capacity Addition & Utilization

- The existing average capacity utilization in manufacturing is around 75%, which reflects sustained economic activity in the sector and is same as in the previous quarter. The future investment outlook has also improved as compared to the previous quarter as over 56% of respondents reported plans for investments and expansions in the coming six months. This is an improvement over the previous survey where 47% reported plans for investments in next six months.

- Global economic slowdown caused by the recessionary climate in the America, EU and other developed nations and Russia-Ukraine war continue to add to volatilities in supply chain and demand.

- High raw material prices, increased cost of finance, cumbersome regulations and clearances, high logistics cost due to high fuel prices, low global demand, high volume of cheap imports into India, shortage of skilled labor, highly volatile prices of certain metals etc. and other supply chain disruptions are some of the major constraints which are affecting expansion plans of the respondents.

- The table below gives average capacity utilization for various sub-sectors of manufacturing.

Table: Current Average Capacity Utilization Levels as Reported in Survey (%)

|

Sector |

Average Capacity Utilization |

|

Automotive & Automotive Components |

80% |

|

Capital Goods & Construction Equipment |

71% |

|

Cement |

85% |

|

Chemicals, Fertilizers & Pharmaceuticals |

65% |

|

Electronics & White Goods |

77% |

|

Machine Tools |

72% |

|

Metals & Metal Products |

80% |

|

Textiles, Apparels & Technical Textiles |

75% |

|

Toys & Handicrafts |

60% |

|

Miscellaneous |

75% |

Inventories

- 85% of the respondents had either more or same level of inventory in Q-4 Jan-Mar FY 2022-23, which is almost equivalent to that of the previous quarter. In Q-1 Apr-June FY 2023-24, about 87% of the respondents are expecting higher or same level of inventory.

Exports

- The outlook for exports seems to be waning as about 30% of the respondents reported higher exports in Q-4 Jan-Mar FY 2022-23 as compared to 28% of the respondents expecting their exports to be higher in Q1 Apr-June FY 2023-24.

Hiring

- The hiring outlook looks positive as over 38% of the respondents are looking at hiring additional workforce in the next three months.

Interest Rate

- The average interest rate paid by the manufacturers has more and less remained same at little over 9% p.a. during last quarter and the highest rate at which loan has been raised is 16% p.a.

Sectoral Growth

- Based on expectations, Electronics & white Goods sector is likely to enjoy strong growth. Sectors like Auto & Auto components and Capital Goods & Construction Machinery are expected to have strong growth forecasts. Cement and Machine Tools sectors are also to experience Moderately strong growth. Rest all the sectors are expected to register Moderate to Moderately low growth in Q-1 Apr-Jun FY 2023-24 as given in the table below.

Table: Growth expectations for Q-1 FY 2023-24

|

Sector |

Growth Expectation |

|

Automotive & Automotive Components |

Strong |

|

Capital Goods & Construction Equipment |

Strong |

|

Cement |

Moderately Strong |

|

Chemicals, Fertilizers & Pharmaceuticals |

Moderate |

|

Electronics & White Goods |

Very Strong |

|

Machine Tools |

Moderately Strong |

|

Metals & Metal Products |

Moderately Low |

|

Miscellaneous |

Moderately Low |

|

Textiles, Apparels &Technical Textiles |

Moderately Low |

|

Toys & Handicrafts |

Moderate |

Note: Very Strong >20%; Strong 10-20%; Moderate 5-10%; Low < 5%

Source: FICCI Survey

Production Cost

- There seems to be an upward trend in the cost pressures on manufacturers in Q-1 Apr-Jun FY 2023-24. The cost of production as a percentage of sales for manufacturers in the survey has risen for 77% respondents, which is higher than 73% as reported in the survey for previous quarter.

- High raw material prices especially that of steel, increased transportation, logistics and freight cost, and rise in the prices of crude oil and fuel have been the main contributors to increasing cost of production. Other factors responsible for escalating production costs include enhanced labor costs, high cost of carrying inventory, and fluctuation in the foreign exchange rate.